Welcome to Alphament!

The time-proven, ready-to-use, and AI-powered active trading tool for liquid stocks and ETFs.

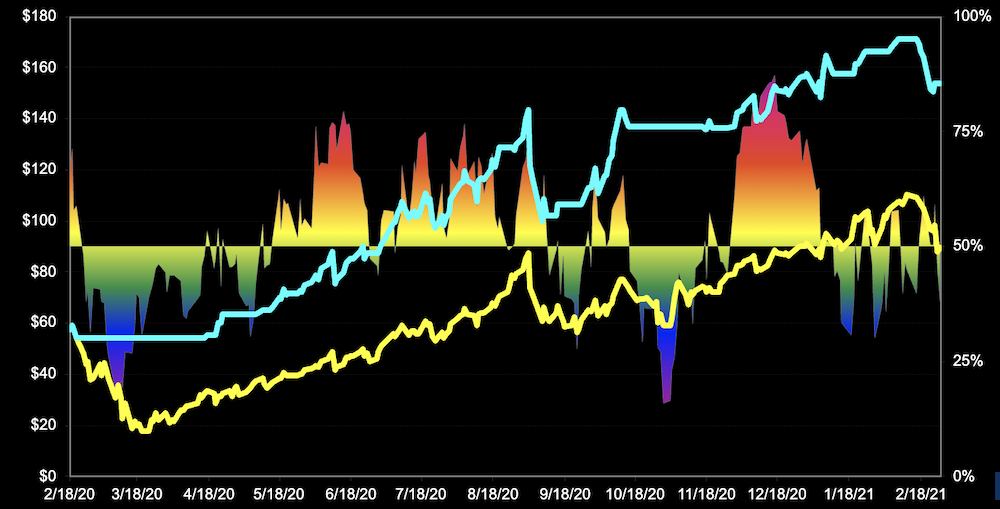

Here is an example of trading using TQQQ as the underlying ETF, which can be any stock or ETF. The Alphament tools give the trading signals for making buy or sell actions. The Alphament outcome for the most recent 12 months is shown below (blue line) vs. simple buy-and-hold strategy (yellow line).

Interesting and unbelievable?

Contact us for a live demo of any stock or ETF that you are interested.

Note that Alphament is available to institutional investors only.

|

ISIR Investor Sentiment Machine

The World's First AI-Powered Real-Time Stock/ETF Popularity Machine ISIR MACHINE IS THE ONLY MACHINE THAT MEASURES MARKET PSYCHOLOGY AS REFLECTED BY THE SUM OF ALL BULLS AND BEARS TRADING ACTIONS.

|