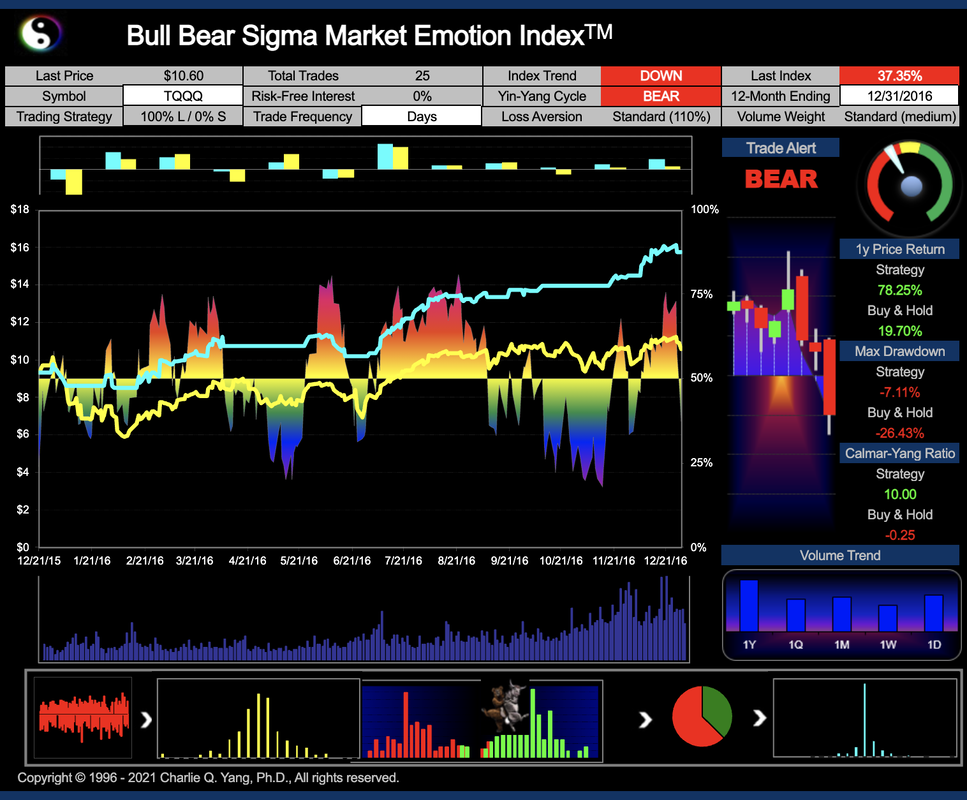

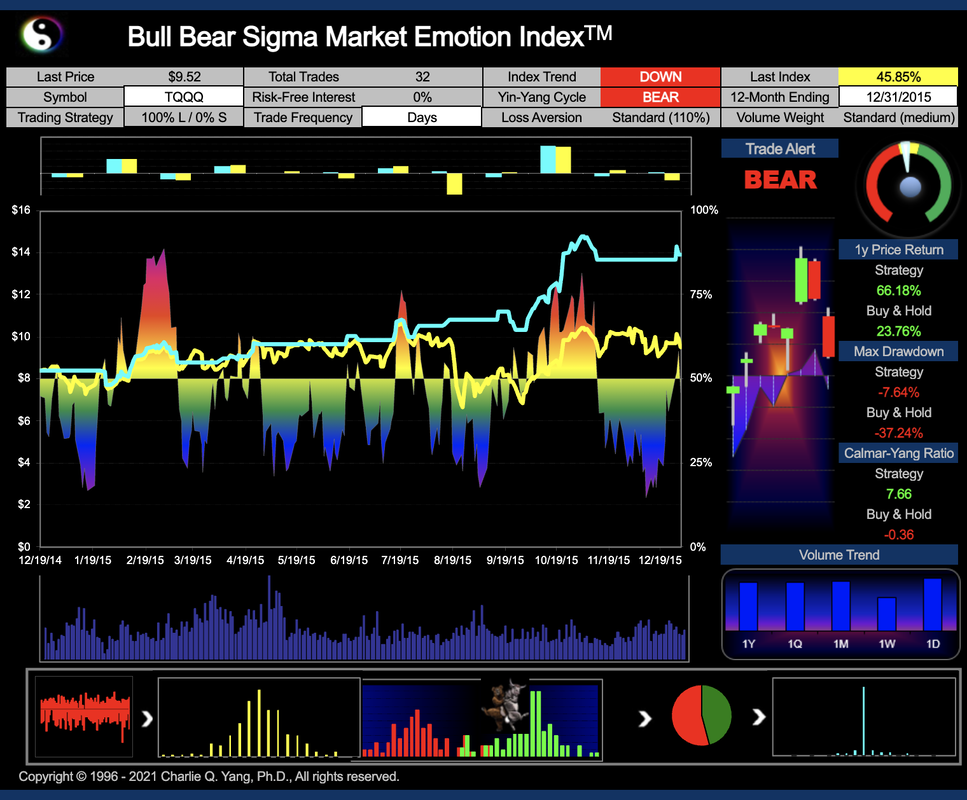

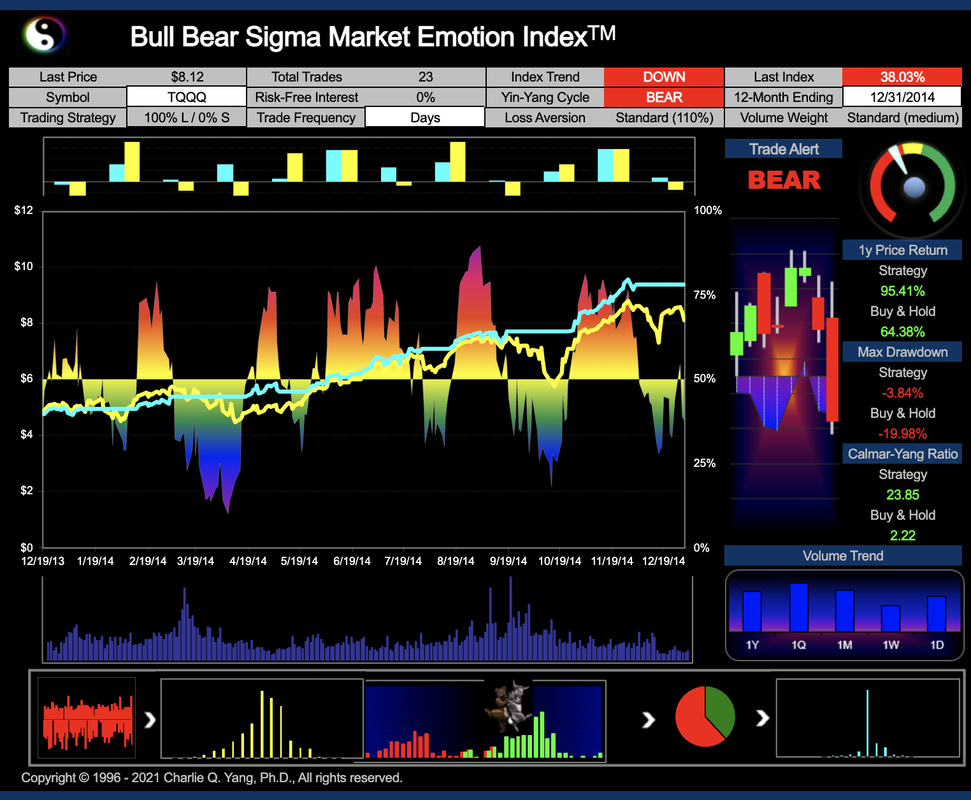

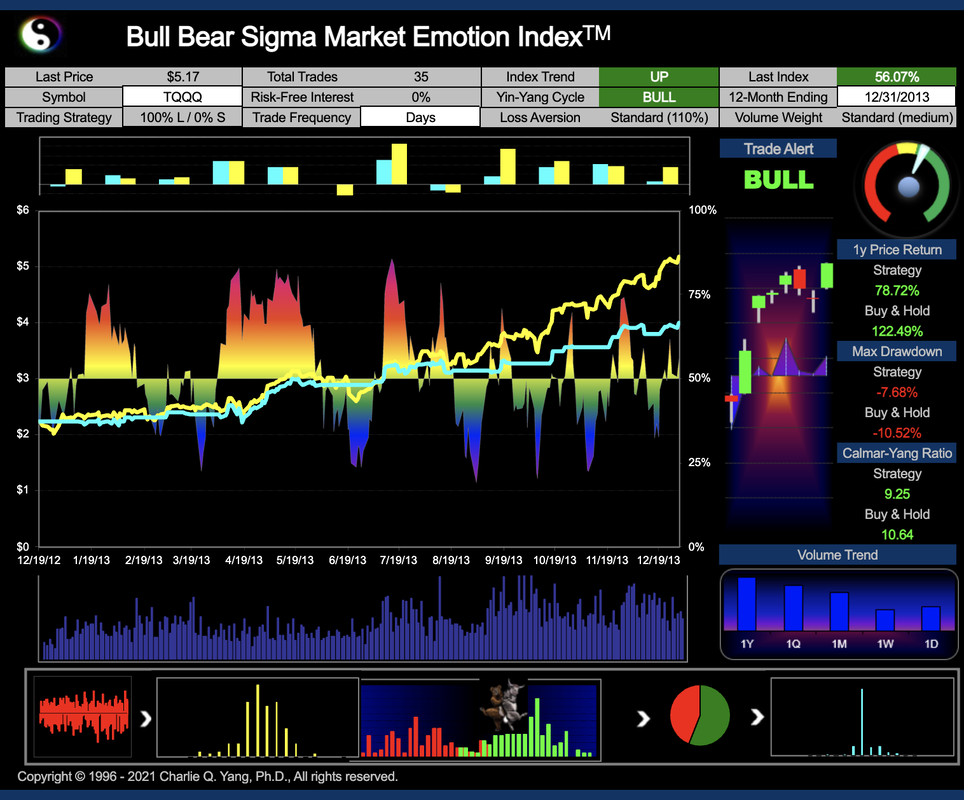

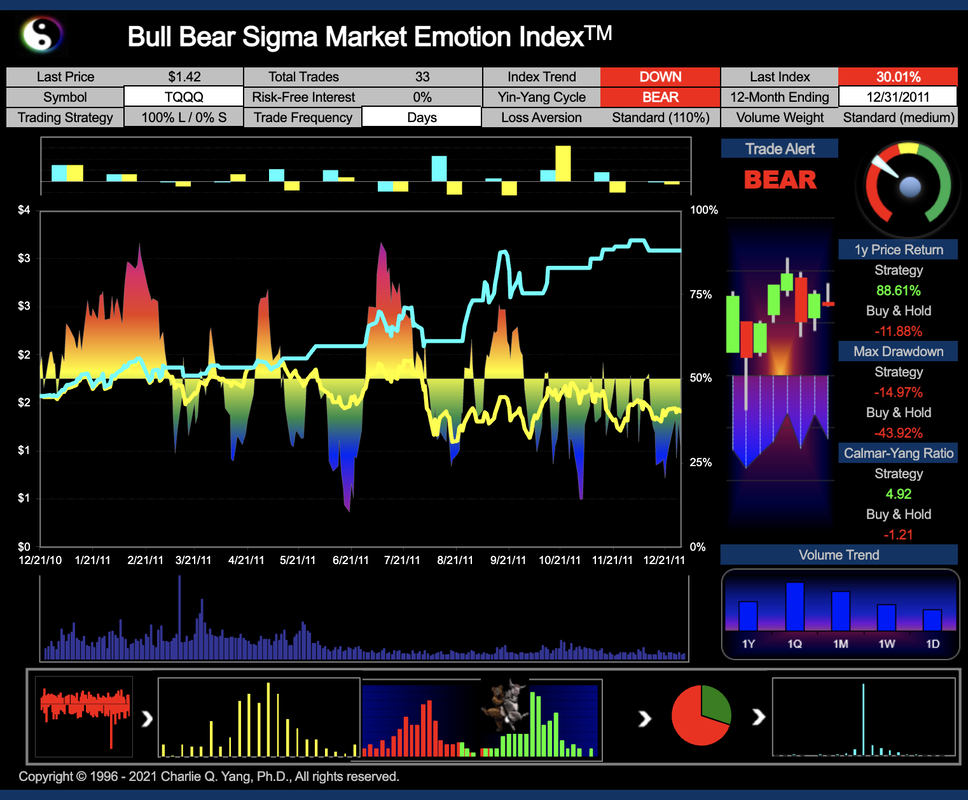

Historical Alphament Portfolio Performance (2011 - 2020)

Important Disclosures and Assumptions

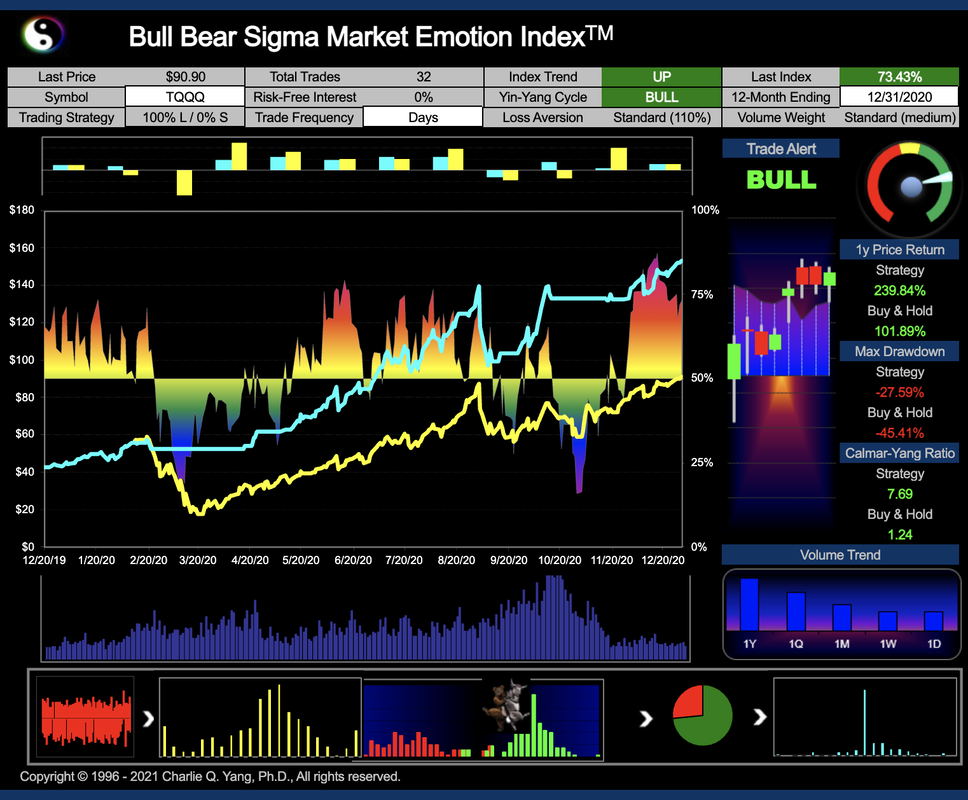

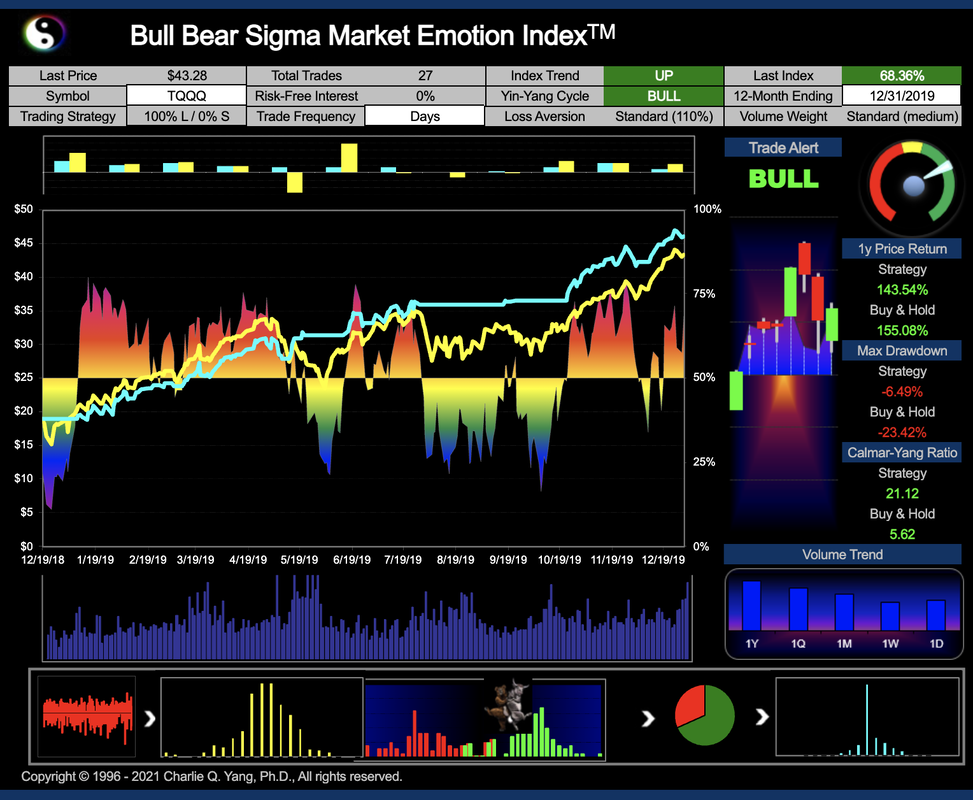

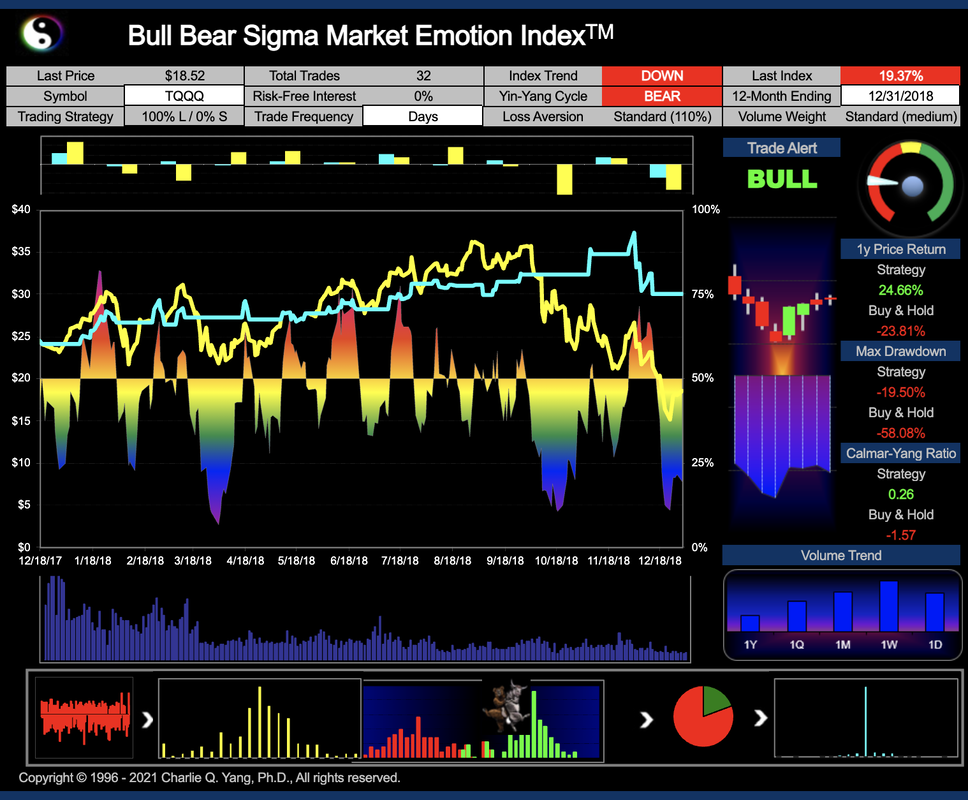

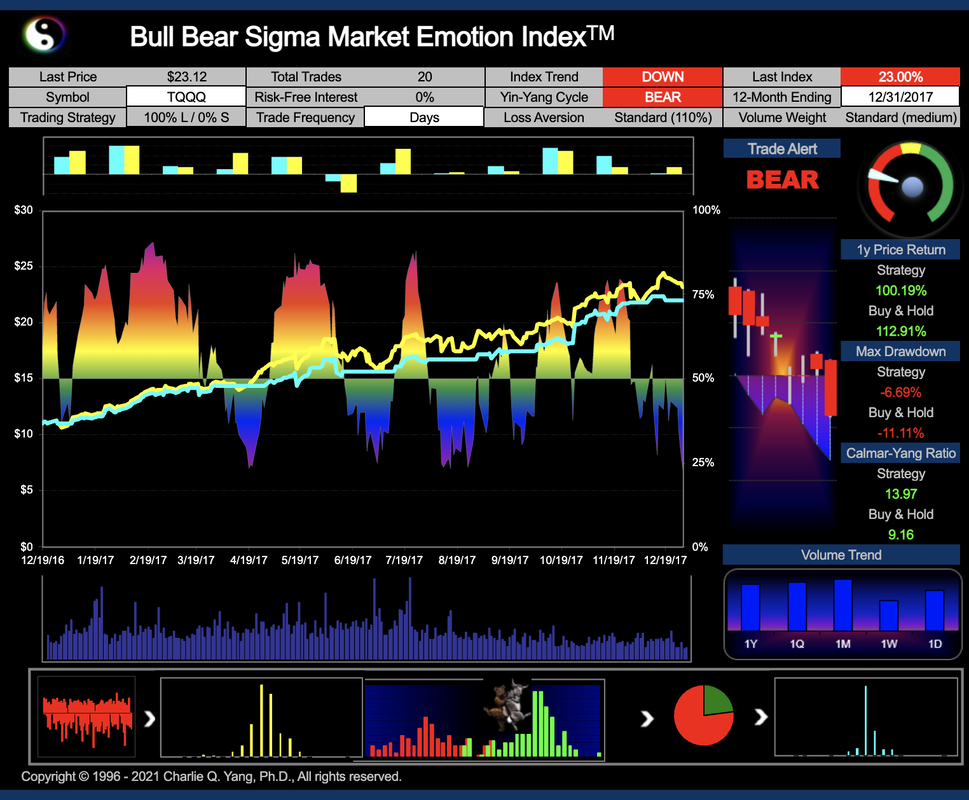

- Annual charts shown are based on the previous 260 trading days before the last day of the calendar year, i.e., each chart shows more than 365 calendar days.

- Annual return numbers shown under each chart is based on 253 trading days for the year.

- The Alphament Strategy result (blue line) is compared to the buy-and-hold benchmark (yellow line) for the same underlying trading security (TQQQ is used as an example).

- Each trade triggered by the BB-Sigma Index 50% crossing is assumed to have the trade order promptly executed at the opening price on the day when the signal is given.